What Is PCI Compliance?

The PCI standards apply to all e-commerce businesses, regardless of size or sales volume.

Failure to remain compliant with PCI standards can result in fines, increased card processing fees, or suspension of credit card processing privileges.

Who’s Responsible for PCI Compliance?

Responsibility for achieving and maintaining PCI compliance is shared equally by merchants, web developers, and web-hosting service providers.

Each has a critical role to play in PCI compliance, though ultimately it falls to the merchant to ensure that their website and web-hosting provider meets the approved industry standards.

How do Businesses Achieve PCI Compliance?

In order to achieve PCI compliance businesses must undergo a rigorous vetting process.

The process consists of:

- Either a quarterly automated scan of their website and hosted servers by an authorized scanning vendor

- Or, alternatively, there’s also an annual self-assessment questionnaire as prepared by the PCI Security Standards Council.

Who Should Use the PCI Compliance Questionnaire?

The self-assessment questionnaire is more appropriate for small businesses who don’t have the resources to hire outside assessors to evaluate a firm’s compliance with the PCI standards.

Ideally, businesses can spot and resolve security issues before a breach happens by working through the questionnaire.

What Are the Requirements for Achieving PCI Compliance?

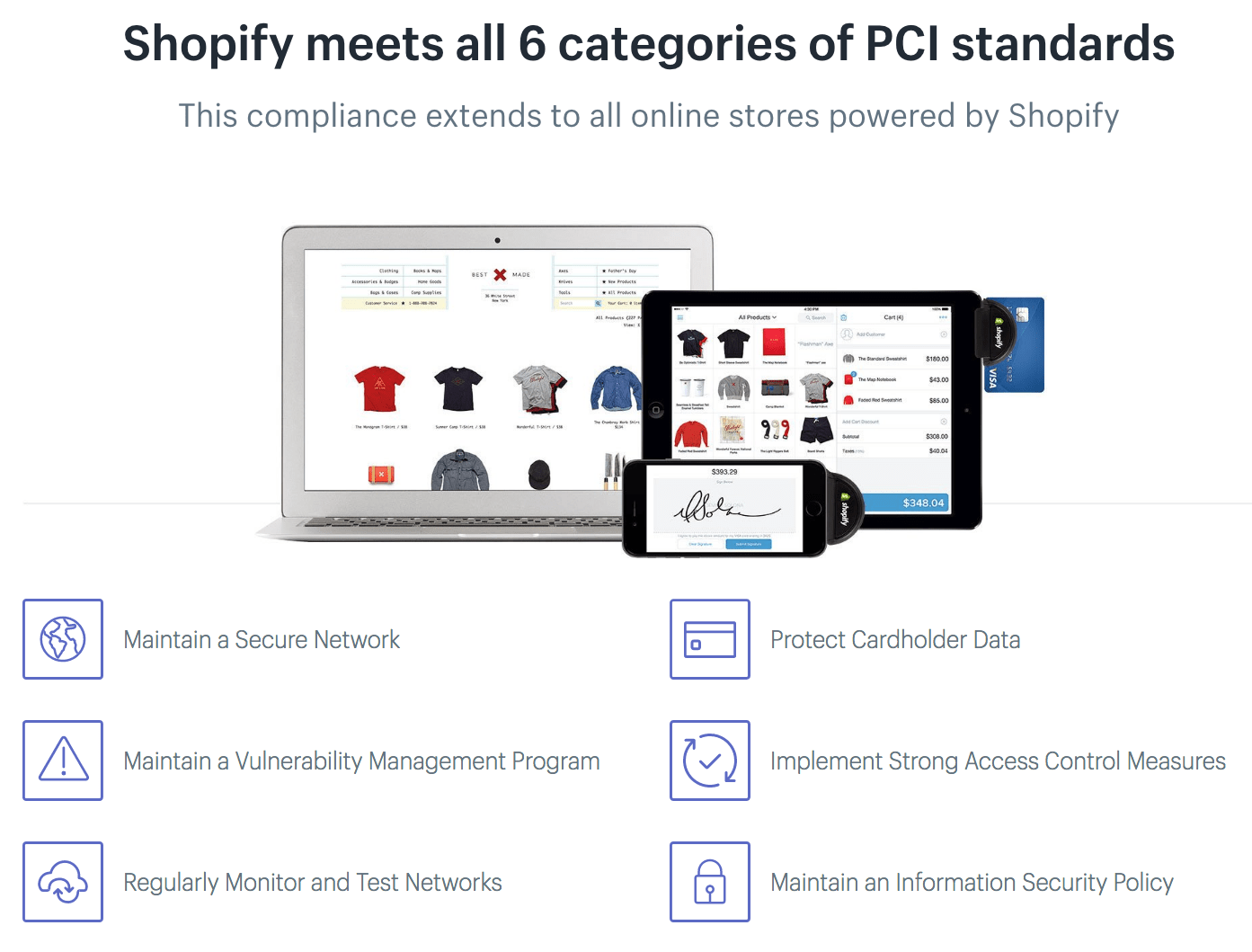

According to the PCI Security Standards Council, there are 12 requirements that must be met in order to achieve PCI compliance.

These can be broken down into six basic categories or security goals (see table below).

Who Is Responsible for Maintaining Compliance?

Some of these requirements are the responsibility of web-hosting providers, while others are the responsibility of merchants and their web developers and site designers.

However, in the final analysis, it always falls to the merchant to ensure that their hosting service, website developer, and third-party software vendors are PCI compliant.

Compliance Security Goals

The goals and requirements necessary to achieve PCI compliance include the following categories, which we’ll explain below.

Building and Maintaining a Secure Network

Responsible party:

Largely the responsibility of the web-hosting provider.

Security goals:

- Installation and maintenance of a firewall in order to create a secure private network

- Creating, maintaining, and updating system passwords that meet or exceed industry standards.

Protecting Cardholder Data

Responsible party:

This is a shared responsibility, though the web-hosting provider should be at the forefront of the secured storage and transmission of all sensitive data.

Security goals:

- Web-hosting providers must utilize a secure data protection model that combines multiple layers of physical and virtual defense procedures that include restricting access to servers and datacenters as well as enforced authentication of passwords and authorization protocols

- Cardholder data, including validation codes and PIN numbers, must be encrypted when transmitted over an open or public network.

Maintaining a Vulnerability Management Program

Responsible party:

Applies primarily to web-hosting service providers, though attention to security vulnerabilities should also command the attention of merchants and their web development team.

Security goals:

- Anti-virus software must be regularly updated, either by the merchant’s IT team if their servers are self-managed or by the hosting provider if data is being housed or processed on outsourced or managed servers

- Web-hosting service providers are expected to routinely monitor and update their systems to combat newly identified security vulnerabilities.

Implementing Strong Access Control Measures

Responsible party:

This is one aspect of PCI compliance that is largely the responsibility of the business owner and their web development team as it addresses data security on a more localized level.

Security goals:

- Restrict access to cardholder data to authorized personnel only

- Assign unique IDs to staff members with access to sensitive data using best practices for password encryption, authentication, and login limits

- Restrict physical access to cardholder data. This primarily applies to web-hosting providers, which should limit on-site access to their datacenters to authorized personnel only.

Regularly Monitor and Test Networks

Responsible party:

A shared responsibility between web-hosting providers and the merchant’s web development team.

Security goals:

- Access to network resources and cardholder data should be regularly monitored for possible security breaches or vulnerabilities. Logging systems should be put in place to track user activity and access to stored archives

- Web-hosting service providers should routinely test and monitor security systems and processes to ensure the continued safety of sensitive data.

Maintaining an Information Security Policy

Responsible party:

This applies to both web-hosting services and web developers.

Security goals:

They should have well-defined security policies in place that outline:

- Operational security procedures

- Acceptable uses of technology

- Basic administrative tasks and safeguards

- Detailed risk analysis data.

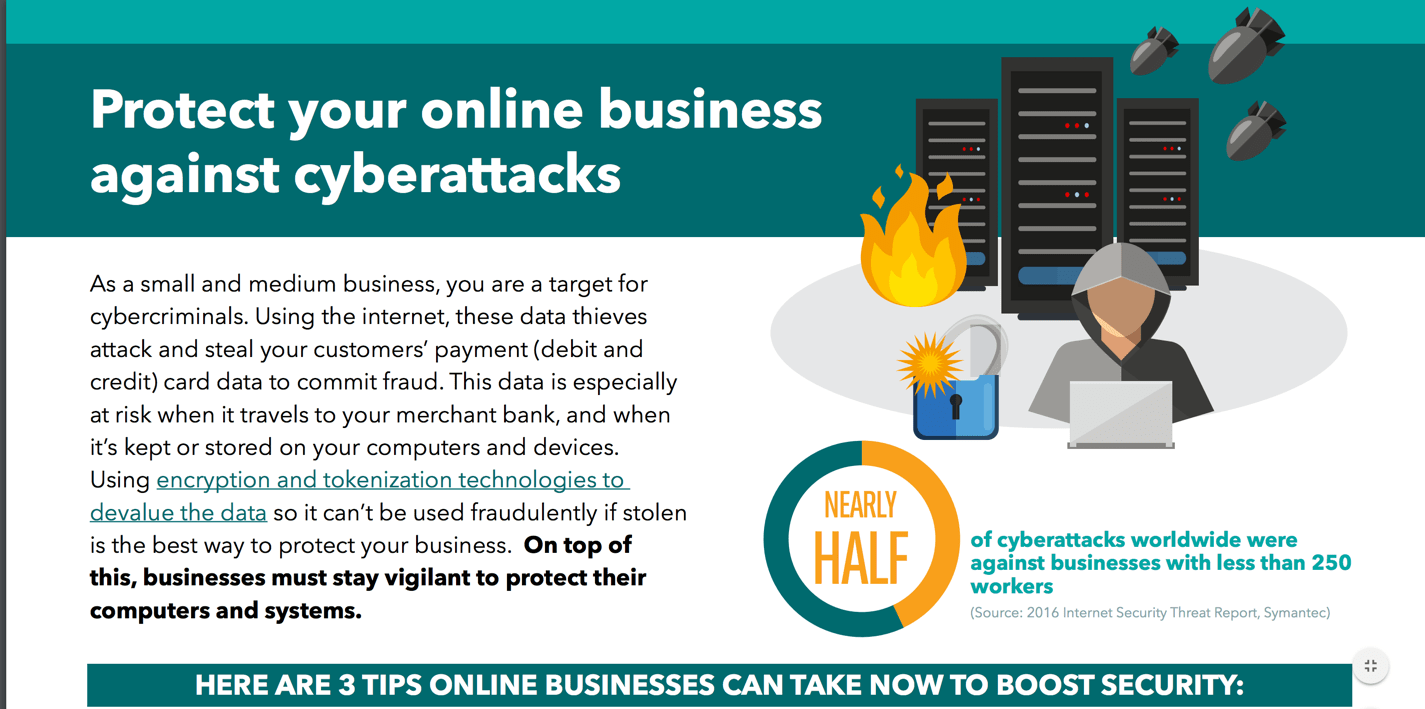

Server Security

So what does PCI compliance have to do with the web host?

Since your e-commerce site is going to handle transactions, hosting companies have an interest in keeping personal and financial information secure. Would you want to do business with a hosting company that had repeatedly suffered security breaches?

HTTP and SSL Encryption

One of the major issues surrounding processing credit card payments is keeping the connection between a user and a merchant encrypted. Over the web, this is done through the use of HTTPS and SSL encryption.

With HTTPS, an attacker can’t see the credit card number or the security number on the card.

SSL Certificates

Many providers offer SSL certificates as part of their hosting plans. These certificates prove that the people behind the website are exactly who they say they are.

You can see them when you click on the padlock on an HTTPS site in the URL bar.

End-to-End Payment Protection

Having an SSL certificate is not enough to achieve PCI compliance. The entire chain of payment processing, going from card handling to the physical servers themselves, has to be PCI-DSS compliant.

Physical Access Protections

Security also means physical security. A random person shouldn’t be able to walk into a datacenter and start messing with one of the server racks.

Larger hosts have secure datacenters, where the server racks are kept under lock and key. Many of them have strict rules enforced by measures like key cards on who can be in a datacenter at all.

Other Security Considerations

Besides PCI-DSS, depending on the business you’re in, you have to keep up with other security and privacy standards and laws.

For example, if you’re in the US and you deal with health data in any way, you’re subject to HIPAA (Health Insurance Portability and Accountability Act).

You have to make sure that this data won’t fall into the wrong hands by employees disclosing it or having data left on a laptop somewhere where it can be stolen.

Don’t rely on a web host to know which security requirements are important for the industry that you serve.

Employee Training

The moral of the story is that for all the standards, laws, technology, and encryption, the human element is still the weakest link in security.

While implementing PCI-DSS, you should train your employees that they have to be vigilant about security and can’t just rely on the software and web hosting to keep your data integrity safe.

Looking for the right PCI compliance host?

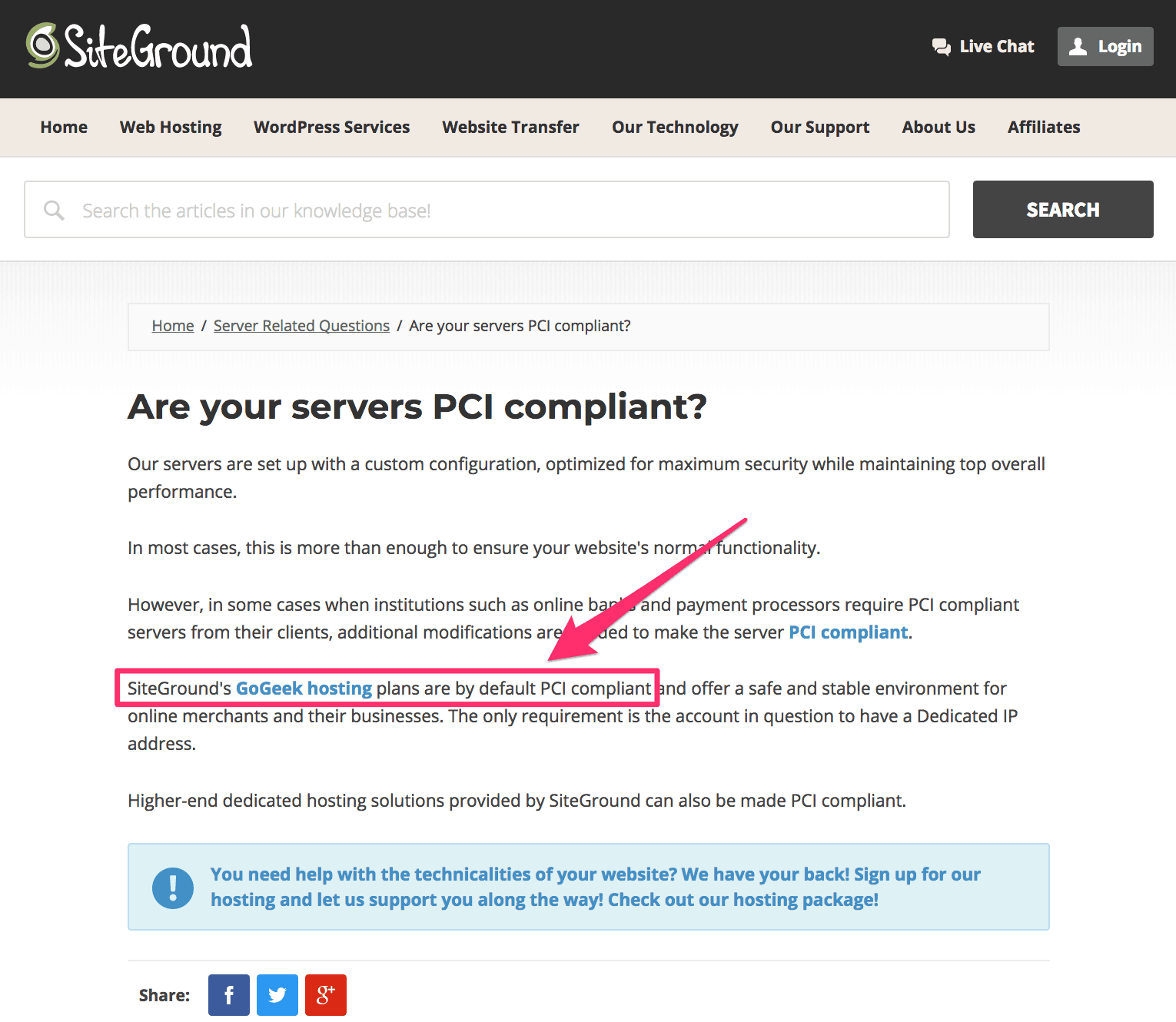

SiteGround – rated #1 by our readers – provides quality PCI compliant hosting on their GoGeek plans. Right now you can save up to 67% on SiteGround plans by using this exclusive discount link.

How to Choose a PCI-Compliant Hosting Service

Choosing a PCI compliant web-hosting service can often be a challenging proposition.

While some web-hosting providers clearly advertise PCI compliance as a marketable feature, many web-hosting providers are less forthcoming.

Here are the steps involved in searching for a web host that offers PCI compliance:

- If a host’s plans don’t specify compliance, ask.

- If your budget requires a cheap shared hosting plan, see if the host offers payment gateways.

- Consider a large hosting company.

- Consider site builders with e-commerce options.

- Consider paying a bit more for hosting.

Let’s go into a bit more detail on each of these steps.

When in Doubt, Ask Web Hosts About PCI Compliance

It is often necessary for merchants to contact potential hosting firms directly in order to verify if PCI compliant hosting plans are available and if they meet their business’ operational and budgetary demands.

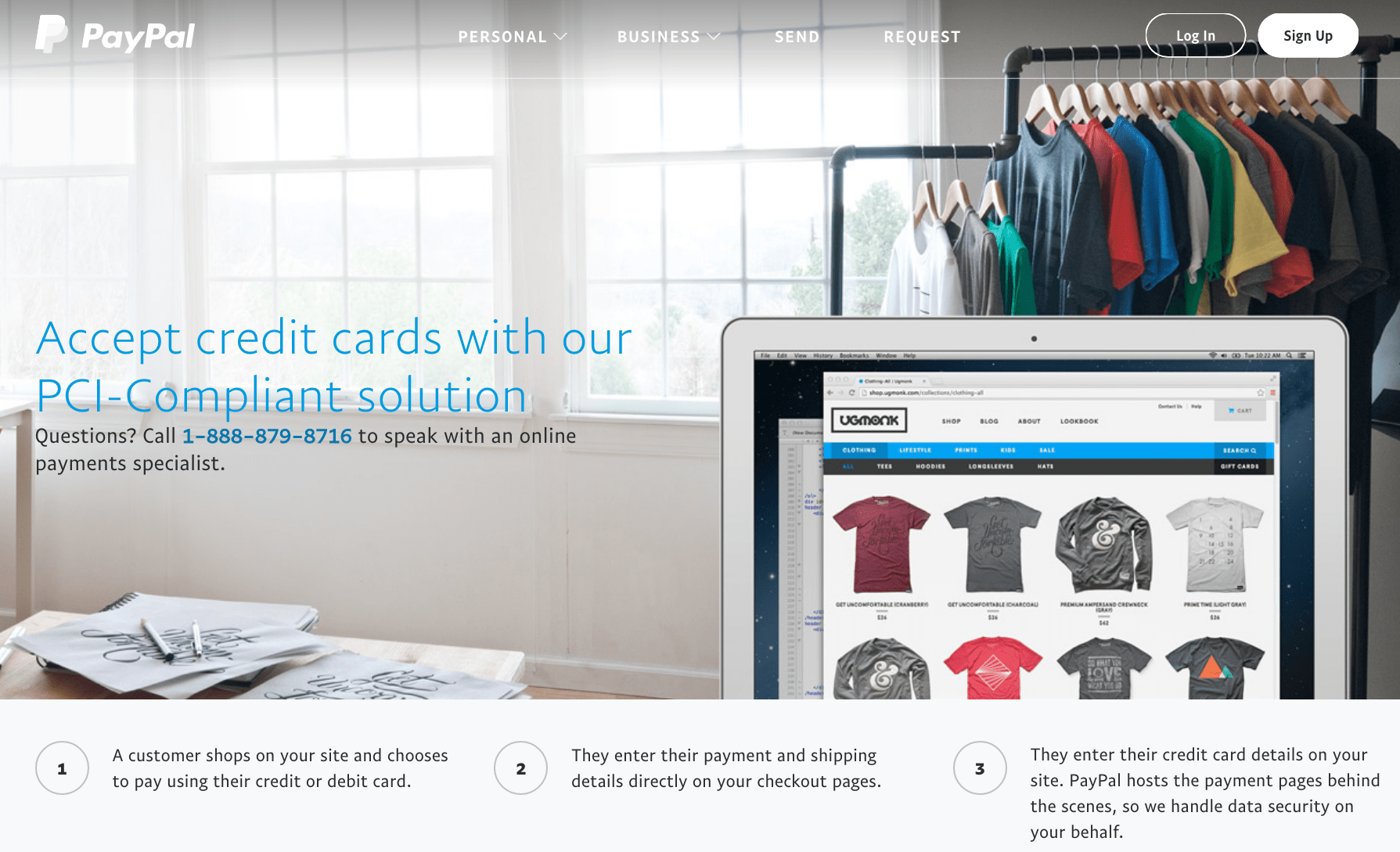

Use a Payment Gateway, If Necessary

Smaller business operations, particularly those relying on budget-priced shared hosting plans, may find it necessary to partner with a third-party payment gateway service (such as PayPal) in order to ensure PCI compliance.

Since most shared hosting plans do not deliver the heightened security features necessary to meet PCI standards, you might want to take advantage of e-commerce features that their hosts offer.

Bigger Hosts Are a Good Choice for PCI Compliance

The choice of hosting provider also affects PCI compliance. Larger providers will have more resources to ensure Payment Card Industry Data Security Standard (PCI-DSS) compliance.

Larger hosting providers are more likely to:

- Offer SSL certificates,

- Keep up with software updates, and

- Either perform the self-assessment questionnaires themselves or

- Afford the quarterly assessment.

Look for E-Commerce Features and Site Builders

Some of these hosts offer payment processing and e-commerce features, often through site builders.

For small businesses especially, these can provide attractive alternatives to managing their own PCI-compliant payment processing systems.

Consider Higher-Tier Hosting Plans

In most cases, business owners will need to consider VPS, Cloud, or dedicated server hosting plans in order to achieve full and independent PCI compliance as outlined by the Payment Card Industry Security Standards Council (PCI-SSC).

“As we do more and more of our business online, and as criminals realize the value of the data that organizations are protecting, we’re seeing more big-name breaches, more high-profile breaches.”

-Mark Nunnikhoven, VP Cloud Research, Trend Micro, in an interview with CNN.

Our Picks for the Best PCI-Compliant Hosts

After researching PCI compliance, we prepared 3 recommendations for you to explore. Each host listed here is PCI-compliant.

| Feature | SiteGround | InMotion Hosting | Liquid Web |

Min Monthly Price | $3.95 | $34.19 (PCI comp. VPS) | $29.00 |

| PCI Compliant | Yes | Yes | No |

| Plan Types | Shared, WordPress, Cloud, Dedicated | Shared, WordPress, VPS, Dedicated | Cloud, WordPress, VPS, Dedicated |

| WooCommerce Plan | Yes | No | Yes |

SiteGround

For PCI-compliant hosting, we recommend SiteGround.

While they have cheap shared hosting, their lower tiers are not appropriate for e-commerce. Their higher tiers – like the GoGeek plan – achieve PCI compliance through secure datacenters.

Having a dedicated IP address is necessary for PCI compliance.

Their other dedicated servers, cloud hosting, and VPS can also be made PCI-compliant.

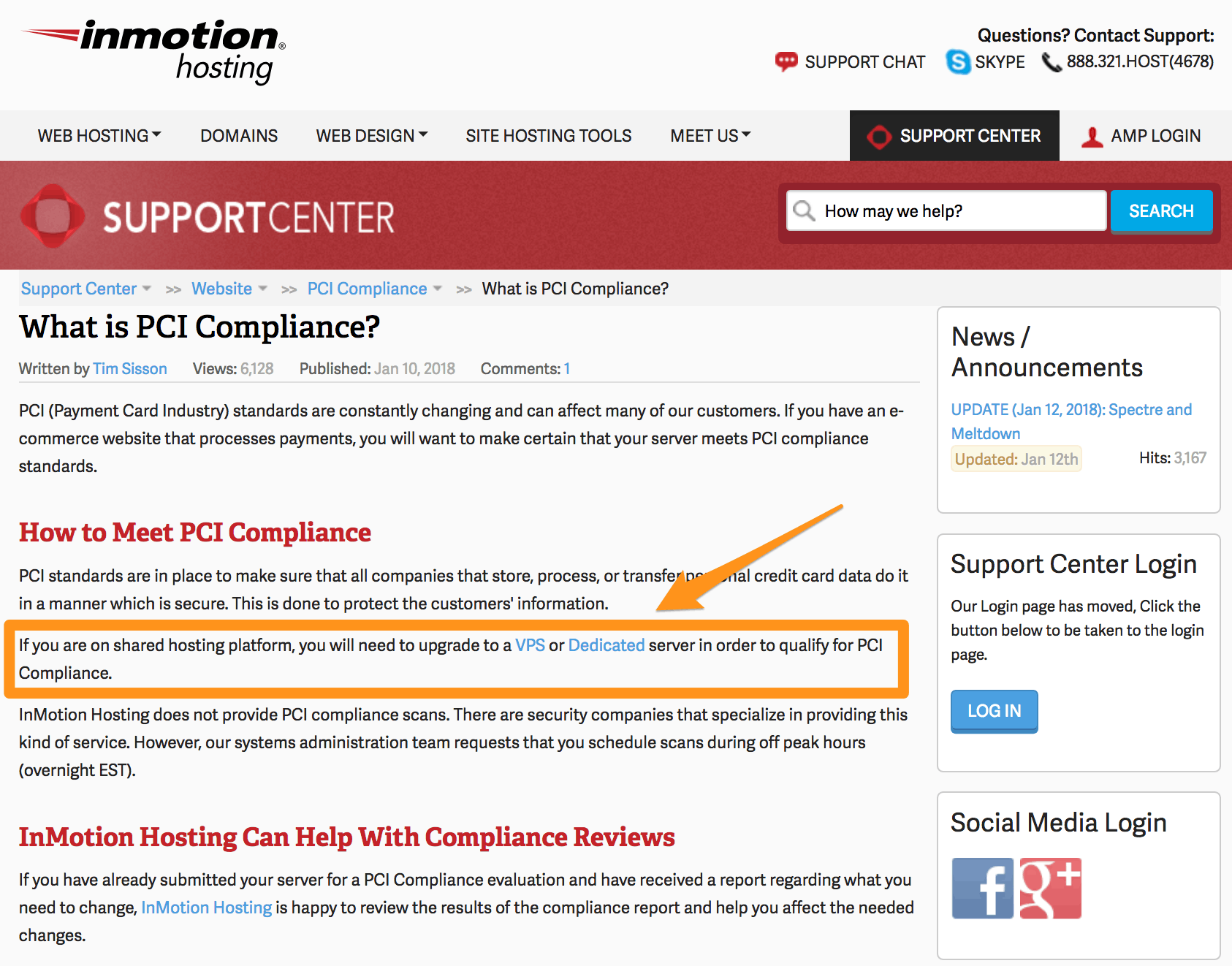

InMotion Hosting

InMotion is also a good choice for e-commerce.

They offer 1-click e-commerce on their hosting plans via PrestaShop and OpenCart.

They include security features like SSL certificates, automatic backups, and DDoS protection.

InMotion advises clients interested in PCI compliance to opt for VPS plans or dedicated plans.

The host will assist you in making any necessary customizations to meet requirements of a PCI compliance scan. They also offer advice on how to pass PCI compliance in their knowledge base.

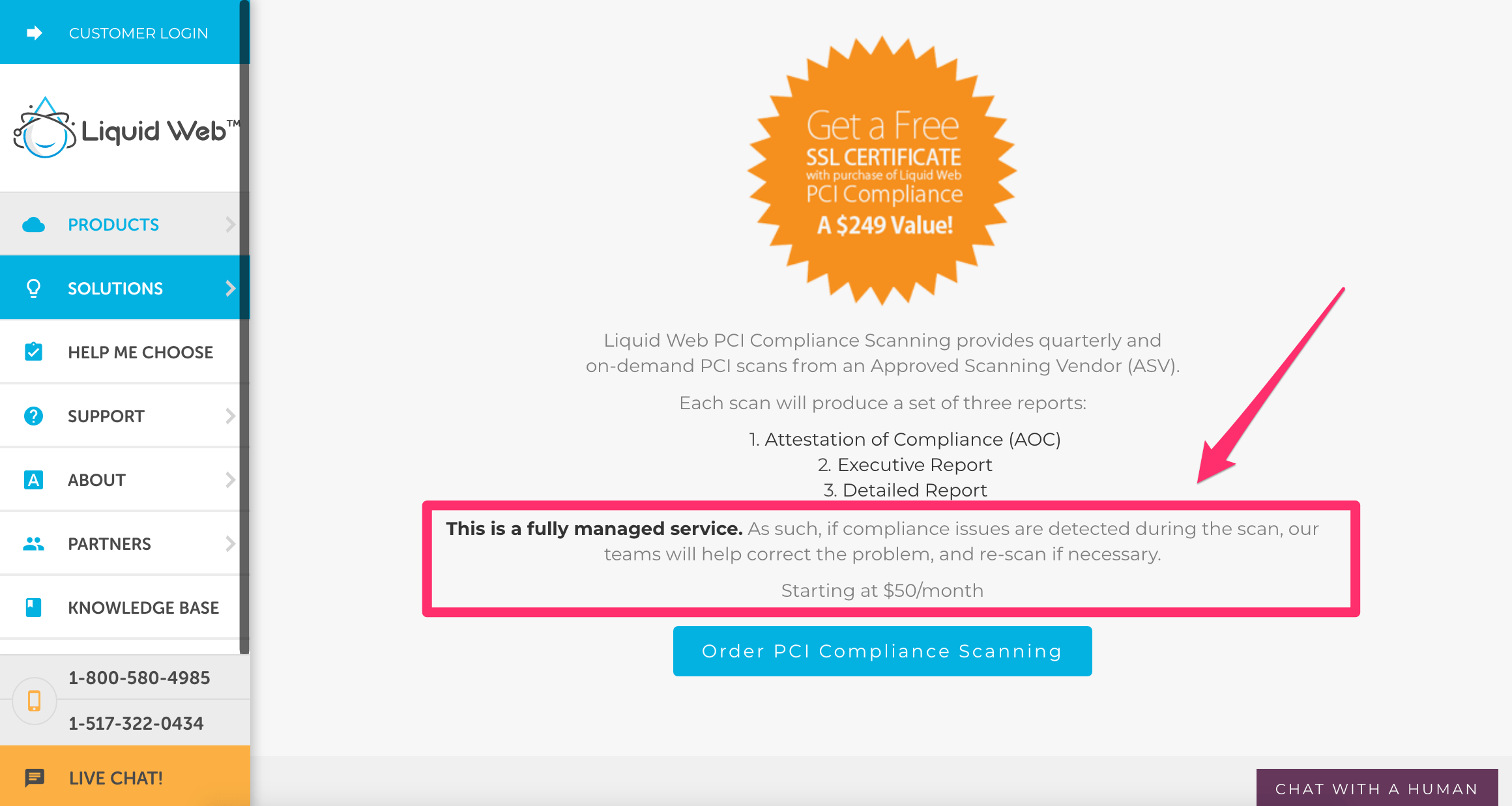

Liquid Web

Liquid Web is yet another hosting provider that offers advice on achieving PCI compliance but leans on the client to ensure that they are certified.

This means passing the self-assessment questionnaire.

Liquid Web offers dedicated servers, cloud VPS, dedicated cloud, as well as more advanced solutions.

These offer a lot more control than shared hosting and are good choices for running PCI-compliant sites.

Other features in E-commerce

Looking for PCI compliant hosting for WordPress?

WP Engine provides advanced security and fast server speeds and supports PCI compliance. Right now you can save up to 20% on their plans. Use this discount link to save big.

PCI Compliant Frequently Asked Questions

- Does an SSL Certificate make my business PCI compliant?

No. SSL certificates do provide a basic level of customer security and assurance, but they do not secure a web server from potential malicious attacks. Although SSL certificates alone are not enough to comply with PCI-DSS measures, they are a key part of PCI standards and are thus vital for all customer-facing online businesses.

- Can you be fined for not being PCI compliant?

PCI-DSS is not a law, merely a set of industry standards created by the major credit card brands. However, merchants that fail to comply with PCI-DSS may be subject to fines, increased processing fees, card replacement costs, forensic audits, and brand damage in the event of a breach or data compromise. More, legal action may result in unwanted financial costs for non-PCI compliant companies.

- Is PCI compliance mandatory?

PCI compliance is mandatory for merchants that handle customer payment information in order to ensure the safety of the customers’ data. PCI compliance is not defined by a set of laws per se; however, businesses that handle customer credit card information must adhere to PCI-DSS standards.

Comments