Tech Giants and Their Overflowing Cash Coffers

Disclosure: Your support helps keep the site running! We earn a referral fee for some of the services we recommend on this page. Learn more

One of history’s richest men, Andrew Carnegie, was worth nearly half a billion dollars at his death in 1919. Adjusted for inflation, his fortune would total more than $90 billion today. His contemporary, John D. Rockefeller, was even wealthier, having amassed holdings worth more than $1.4 billion (between $231 and $330 billion in today’s money) when he died in 1937.

A quick review of Rockefeller’s fortune shows it accounted for 1/65th of the nation’s gross domestic product (GDP) and was enough (had he been so inclined) to provide every person in America with $10 (a princely sum in a time when steak could be had at $0.20 a pound and a gallon of Rockefeller’s very profitable gasoline was a dime).

Wealthy enough to give old Scrooge McDuck a run for his money, to compare these men and their peers to the tech titans of today makes the latter seem downright impoverished. Yet even in a world haunted by the twin specters of austerity and sequesters, these latter-day denizens of the financial heights (corporations with empires consisting of silicon and data instead of oil and steel) have managed to amass positively enormous piles of cash.

As the United States economy struggles back from the worst recession since Rockefeller’s era, federal belt-tightening has boosted domestic recovery while the gradual return of consumer confidence has given modern technological megaliths enormous profits.

Collectively, the top five tech companies—Apple, Microsoft, Google, Oracle and Cisco—have a cash surplus of $333 billion, or enough to give every man, woman, and child in the world almost $50. While a collective decision to fork over a “fast fifty” to the entire population of planet Earth is as unlikely as Rockefeller slipping the American people a sawbuck each, it can be diverting to contemplate the potential purchases made possible by such funds. After all, one third of $1 trillion is more than enough cash to educate millions, feed an army, or even buy up an entire city.

Tech Giants and Their Overflowing Cash Coffers

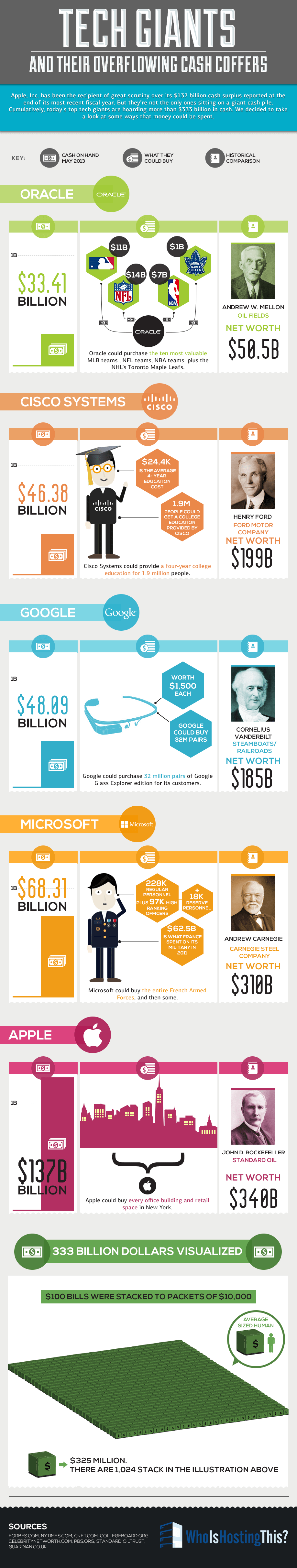

Apple, Inc. has been the recipient of great scrutiny over its $137 billion cash surplus reported at the end of its most recent fiscal year. But they’re not the only ones sitting on a giant cash pile. Cumulatively, today’s top tech giants are hoarding more than $333 billion in cash. We decided to take a look at some ways that money could be spent.

Oracle

- Cash on hand (May 2013): $33.41 billion

- What they could buy: Oracle could purchase the ten most valuable MLB teams, NBA teams, plus the NHL’s Toronto Maple Leafs.

- Historical comparison: Andrew W. Mellon – oil fields – net worth: $50.5b

Cisco Systems

- Cash on hand (May 2013): $46.38 billion

- What they could buy: Cisco Systems could provide a four-year college education for 1.9 million people.

- $24.4k is the average 4-year education cost

- 1.9m people could get a college education provided by Cisco

- Historical comparison: Henry Ford – Ford motor company – net worth: $199b

- Cash on hand (May 2013): $48.09 billion

- What they could buy: Google could purchase 32 million pairs of Google Glass Explorer edition for its customers.

- Worth $1,500 each

- Google could buy 32 million pairs

- Historical comparison: Cornelius Vanderbilt – steamboats/railroads – net worth: $185b

Microsoft

- Cash on hand (May 2013): $68.31 billion

- What they could buy: Microsoft could buy the entire French Armed Forces, and then some.

- 228k regular personnel plus 97k high ranking officers

- 18k reserve personnel

- $62.5b is what France spent on it’s military in 2011

- Historical comparison: Andrew Carnegie – Carnegie Steel Company – net worth: $310b

Apple

- Cash on hand (May 2013): $137 billion

- What they could buy: Apple could buy every office building and retail space in New York.

- Historical comparison: John D. Rockefeller – standard oil – $340b

Comments