What Is a Payment Gateway?

Does your business plan include offering its products and services for purchase online?

Unless you plan to be the first business in history to accept cat photos and tweets as payment, your site is going to need support for, and access to, a payment gateway.

Why Do You Need a Credit Card Payment Gateway?

If you’re planning on doing business online, it’s essential to be able to accept credit card payments.

Credit cards account for 90% of online sales, so if you don’t accept them, you’re losing out on that revenue.

While solutions like PayPal might work for occasional transactions, opening up a merchant account to process your credit card payments can be a more efficient and cost-effective solution for higher-volume online businesses..

Security of Payment Gateway Transactions

Payment gateways are the online equivalent to the checkout lane at your local store.

They provide a secure and reliable method for processing online transactions by encrypting customer credit card information.

The encrypted data travels between the customer, their financial institution, and the merchant selling the product or service.

How Payment Gateways Work in 6 Simple Steps

Payment gateways are analogous to the checkout counter in a brick and mortar store.

There are no more wheeling carts up to counters. Instead, customers select their items, enters their payment details, followed by a one-click checkout on your site’s e-commerce software.

The payment gateway procedure is fairly straightforward:

- Browser Encryption

- Data Sent to Gateway Server

- Data Sent to Your Bank

- Data Forwarded from Your Bank

- Authorization

- Authentication

All of this takes less than five seconds to occur.

Browser Encryption

The customer’s browser uses its built-in encryption (generally with HTTPS [HyperText Transport Protocol Secure] protocol).

This protects their information as it is sent from their computer to your server.

Data Sent to Gateway Server

Your server sends the information to your designated payment gateway server, protecting the information with SSL (Secure Socket Layer) encryption. The payment gateway server must receive this data.

Data Sent to Your Bank

The payment gateway forwards the purchase to your bank, again using SSL. The data’s route through the bank is a key step to achieve payment authorization.

Data Forwarded from Your Bank

Your bank forwards the information, still using SSL encryption. The customer’s bank or credit card payment processing agent receives this to verify funds.

Authorization

The payment processor returns either an authorization or a failure to the payment gateway, based on available credit or funds.

If approved, the authorization is added to your daily “take” for processing by your bank at the end of the business day.

Authentication

The payment gateway sends the response back to your web server, where your e-commerce software either finishes the transaction or rejects it.

Online Credit Card Payment Solutions

If you’re just starting out online, many hosting packages include support for e-commerce. In fact, it’s almost expected of hosting plans to cover e-commerce standards.

Merchant Fees and Per-Transaction Fees

Usually, PayPal is used as a payment gateway to accept major credit cards. PayPal does, however, charge merchant fees for payment processing.

Anyhow, these fees are often much lower than for higher-volume payment processors.

PayPal can seem like an ideal solution. They don’t charge any fees besides the per-transaction fee.

Benefits of Merchant Accounts

While some have worries about PayPal disputes, there is a strong community page with plenty of resources.

However, there are other factors for businesses to consider besides fees. Merchant accounts provide many features missing from PayPal, such as dispute resolution, fraud protection, and security.

Using a merchant account, funds are deposited directly into your bank account.

This isn’t the case with PayPal, although withdrawals are simple. With a merchant account, you’re using a long-established system backed by the FDIC.

Choosing the manner of any dispute resolution is considered standard.

Regulation of PayPal

PayPal is not an FDIC-insured bank and isn’t required to follow federal banking regulations.

They have the power to freeze your funds and cut off your account access if they suspect fraud. There is no way for you to appeal their decision or argue your case.

In addition, some of your clients and customers may not want to use PayPal. It pays (literally) to have other options available to them.

Being able to accept credit card payments directly on your website instead of sending your customers to PayPal, makes your website appear more professional.

PayPal vs Credit Card as a Customer

It’s important to look at things from a customer’s perspective too. Let’s see the side by side facts of PayPal vs direct Credit Card payments:

| Convenience | Incentives | Conversion | Vulnerability | |

| Credit Card | Details can now be stored in your browser, although it isn’t considered safe | Rewards systems in place, with gift incentives | Currency conversions are done by your bank | Credit card fraud can be easy to fall for, although obvious |

| PayPal | Details are kept safe in your PayPal account, secured by a password | Multiple credit card rewards systems can be linked to your PayPal | PayPal converts your transactions at a disadvantageous rate, should your currency not be accepted | PayPal fraud is common via phishing, fake websites and craftier methods, due to the comfort of the average user |

Dedicated Solutions for Growing Businesses

If your business is well-established and processing a high amount in payments each month, it’s worth doing some research.

You may want to look at more robust, dedicated solutions like Authorize.net or Stripe.com.

Purchasing website hosting directly from some payment gateway companies is also a possibility, to create a “one-stop shop.”

Monthly Fees for Larger Sales Volumes

Depending on your sales volume, you can expect a dedicated payment gateway to carry a monthly fee as well as a standard per-transaction fee.

The per-transaction fee is usually a percentage of each transaction plus a predefined dollar amount.

For example, they might charge you 2.6% plus 30 cents for each transaction. Other fees may be charged for account setup, support, and add-ons.

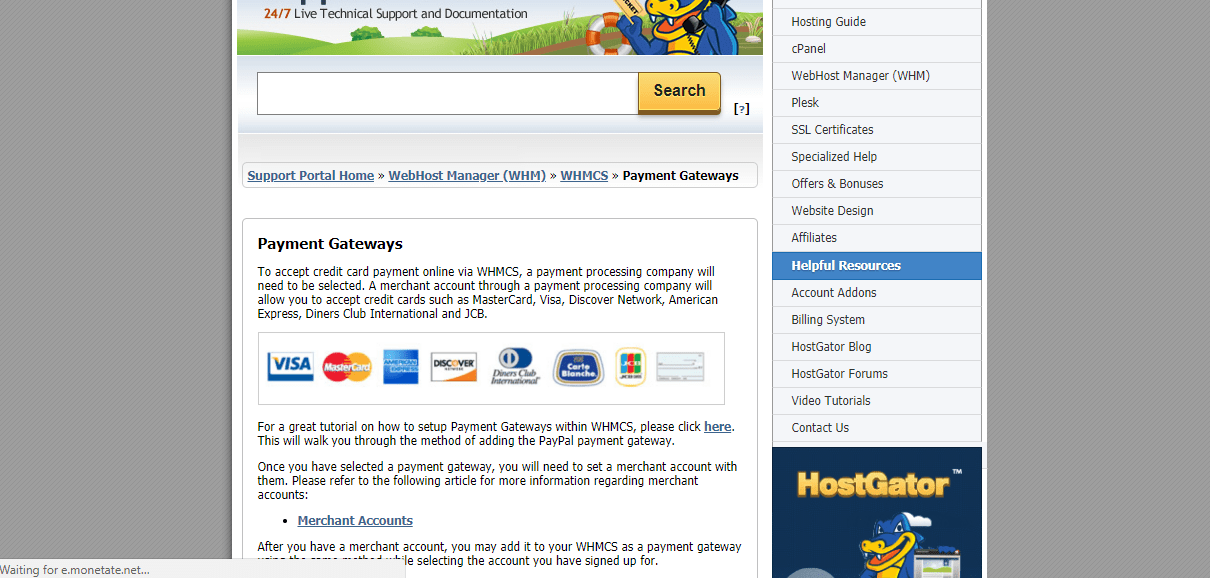

Getting Payment Gateways Through Your Web Host

Many web hosts will provide the option to process credit card payments as a feature of their web hosting plans.

This doesn’t happen automatically when you open your hosting account. You must set up and activate it before you can use it.

These work like other merchant accounts, so there are often still application fees, monthly fees, and per-transaction fees.

Choosing the Right Payment Gateway

Be sure to always get complete information before purchasing a plan from your hosting provider or gateway. Your goal in choosing a payment gateway should be to make easy for your customers to pay you.

When choosing a payment gateway to make sure you keep your customer’s needs in mind.

You’ll probably want the ability for your customers to pay via most major cards. Moreover, you’ll likely also want debit card payment, which is typically linked.

Integration and User Experience

Another consideration to take into account is how the payment process integrates with your website.

If the payment gateway integration you’re utilizing doesn’t offer the best user experience, then this could actually cut into your sales.

Choose your payment gateway provider wisely. Select the provider that’s not only best for your need but for your customers as well.

Looking for a great deal on payment gateway hosting?

Bluehost makes it easy to set up payment gateways and WooCommerce stores. Right now you can save up to 65% on Bluehost plans by using this special discount link.

5 Key Features to Spot with Payment Gateways

All-in-all, you want to keep an eye on 5 important points when selecting a payment gateway:

- Security;

- Responsibility;

- Convenience;

- Fees;

- Ease.

Let’s expand on these features to get a better idea of what you should look for.

Security

Realistically, how safe is your customer’s data? Once your visitor’s data is in your hands, it’s your partial responsibility to protect it. This doesn’t only build trust, but an overall respectable image for your business.

Responsibility

Who is in charge of that data? Are you fully responsible or is the payment gateway service?

You should know the answers to these questions for both legal and ethical reasons.

Convenience

Is the selected gateway convenient to use? Put yourself in your customer’s shoes and be real.

How much hassle must I endure to get to the end of my checkout? Simply test out each service to decide what is right for your shoppers.

Fees

Are the fees reasonable to you? How about your customers? You can obviously be selfish here, but then you’re risking losing some valuable customers.

Keeping them happy will keep you happy in the long run. Look for those lower fees for both parties.

Ease-of-Use

How simple is the integration, or your host may already have it ready for you?

It’s certainly worth addressing your time as an investment with integration and set-up, aside from general use. Time is valuable.

Credit Card Payment Gateway Alternatives

Planning on creating an e-commerce store from day one? Then you’ll need an e-commerce payment gateway that integrates with your existing site and shopping cart.

Most web hosts who offer integrated payment gateways and e-commerce builders tend to bundle the two together.

Importance of SSL certificates

Having an SSL certificate is a must – not only for trust but for security.

After all, what good is an e-commerce site if you can’t actually take payments? Also, keep in mind that you’ll need an SSL certificate to process secure online payments.

So, check with your host to see if an SSL certificate is included in your hosting.

Some hosts also specialize in WooCommerce payment gateways. Are you using WooCommerce to build out your online store?

Then check that WooCommerce specific payment gateways are included in the price of your host.

Other Alternative to Hosted Payment Gateway

Hosted payment gateways are probably the most professional way to accept payments through websites today.

They aren’t required in order to accept online payments though.

Shared Payment Gateways

You may not want to operate a hosted payment gateway on your website and still take payments online for your products and services.

In this case, the primary alternative is a shared credit card payment gateway.

Shared payment gateways take your website visitors off of your website to a payment provider like PayPal or 2CO, who then takes your credit card information, processes the transaction, and then sends your visitor back to your store once the transaction is complete.

Over-the-Phone Payments

A third alternative and a highly unpopular alternative with most online shoppers today is to take an order with no credit card required. This requires a follow up by phone to complete the transaction.

In an eCommerce scenario, processing payments this way is very inefficient. In the service industries, this may be more practical. Furthermore, using a shared payment gateway is always preferred over having no payment gateway.

3 Best Hosts for Variety of Payment Gateways

Now that we have covered the majority of payment gateway choices, it’s time for the top three.

These three hosts have been selected purely on convenience and trust factors of their payment gateway support – take a look.

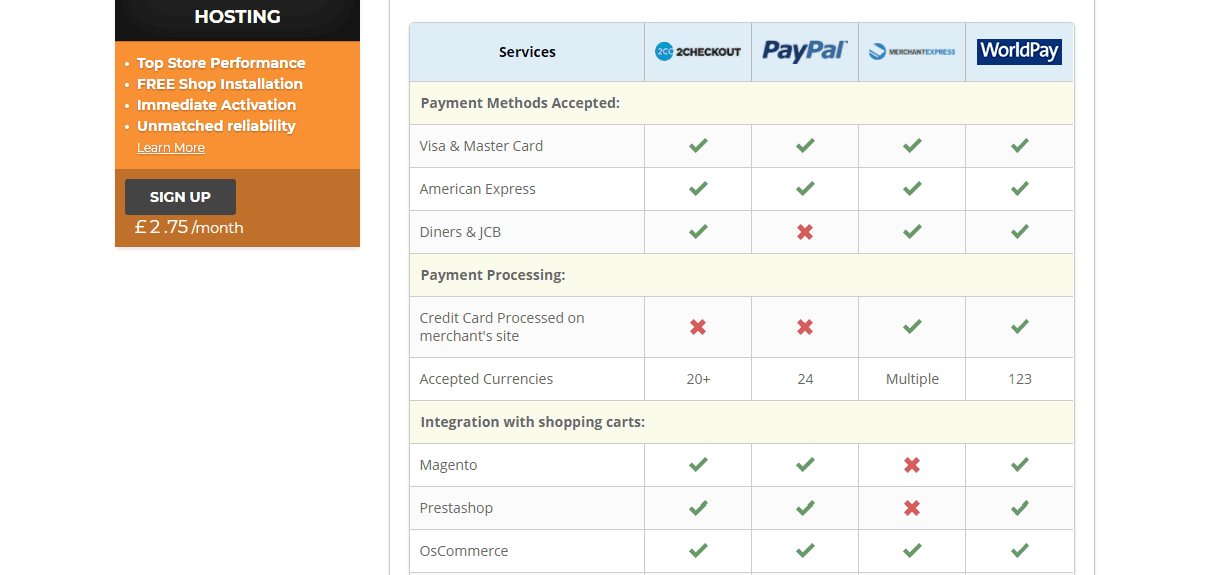

Siteground

Siteground for payment gateways.

Siteground is not only a stellar host for beginners, but they offer a few different options for adding payment gateways to your new website as well.

Siteground currently recommends and integrates with 2Checkout, MerchantExpress, and WorldPay.

If you’re building out an e-commerce store with the included PrestaShop, then you’ll have even more payment gateways to choose from. These include Stripe, Amazon Pay, CloudSwipe, and Skrill Official.

Bluehost

Bluehost for payment gateways.

If you’re looking for another beginner-friendly host that’ll enable you to process payments from your customers, then check out Bluehost.

Bluehost offers a variety of payment gateways.

The easiest option is going to be the integrated merchant service called Payment Sphere.

There’s also a WooCommerce specific hosting package, for those who want to host, build, and accept payments via WooCommerce.

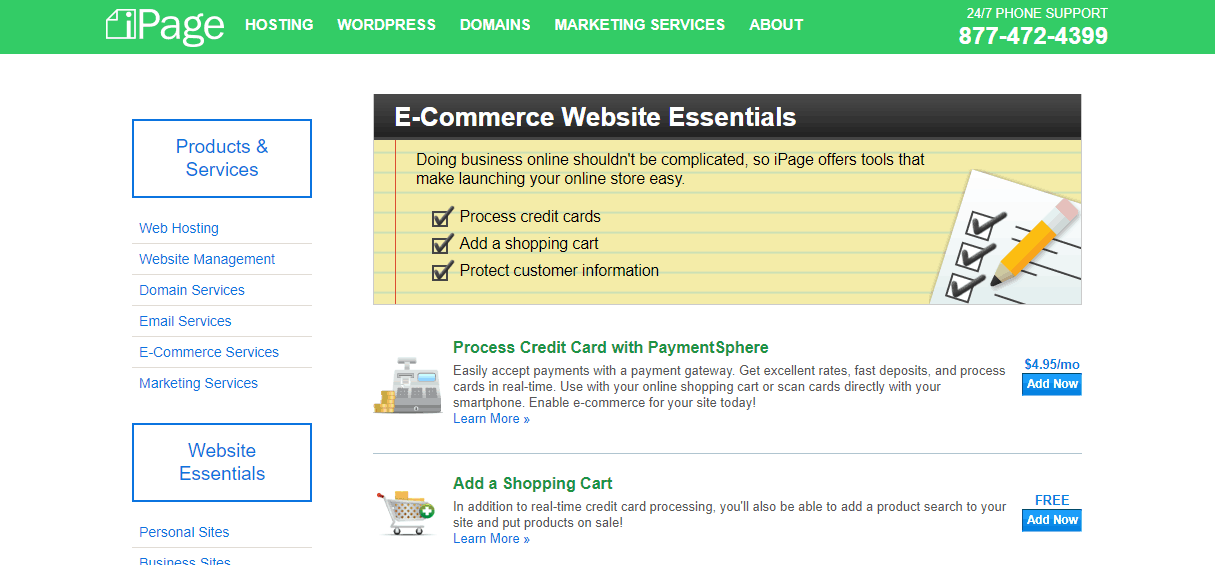

iPage

iPage Hosting for payment gateways.

iPage is another great choice for credit card hosting.

iPage is very beginner-friendly. You’ll be able to easily accept credit card payments via PayPal and AcceptSafe too.

You can set up your payment gateway in a few clicks and will be able to accept payments with Visa, American Express, Discover, and MasterCard.

How Does A Hosted Gateway Compare To A Shared Gateway?

As briefly discussed above, there are two types of credit card payment gateway. One is a hosted payment gateway, where you have a payment service built directly into your website. The other is a shared payment gateway, where payments are accepted through PayPal.

Hosted Payment Gateway

The first and most frequently used is a hosted payment gateway. Hosted payment gateways usually come included in your hosting package. They help effectively and securely process credit cards for online merchants.

If you are an existing brick and mortar retailer, you probably already have an account with a payment processor. It is likely they have a solution for your hosted payment gateway needs that directly connect to their system.

Before you rush to use a new payment gateway offered by your hosting company, it is recommended you start with your existing vendor.

Shared Payment Gateway

By comparison, a shared credit card payment gateway is one used by multiple online stores. The most mainstream solution for a shared payment gateway is PayPal. Furthermore, there are several others on the market that deserve consideration, including:

- 2CO

- WorldPay

- Google Wallet

- Authorize.net.

Many online stores (especially ones new to the market) start out using a shared gateway and then evolve to a hosted gateway over time.

Merchant Accounts for Hosted or Shared Payment Gateways

Some old-school payment gateways require you to have a separate bank account known as a merchant account. This lets you accept both credit and debit card payments.

Depending on the online payment gateway you’re using, this may be a requirement. Most newer payment gateway providers only require an existing bank account.

It is very likely that your hosting provider will offer you some form of payment gateway. Consult with them if you have questions prior to making a decision on a payment gateway for your business.

Looking for a great payment gateway host?

A2 Hosting scored #1 in our recent speed and performance tests. They support numerous payment gateways. Right now you can save up to 50% on their plans. Use this discount link to get the deal.

Comments